Wurst Case

Jason Spilkin February 2025

Germany is synonymous with high quality manufacturing - more so than their sense of humour. Indeed, Audi automobile adverts use the motto “Vorsprung durch tecnik” to subtly highlight their German genes. Continental Tyres put it bluntly, “German engineering when you need it most on a car”.

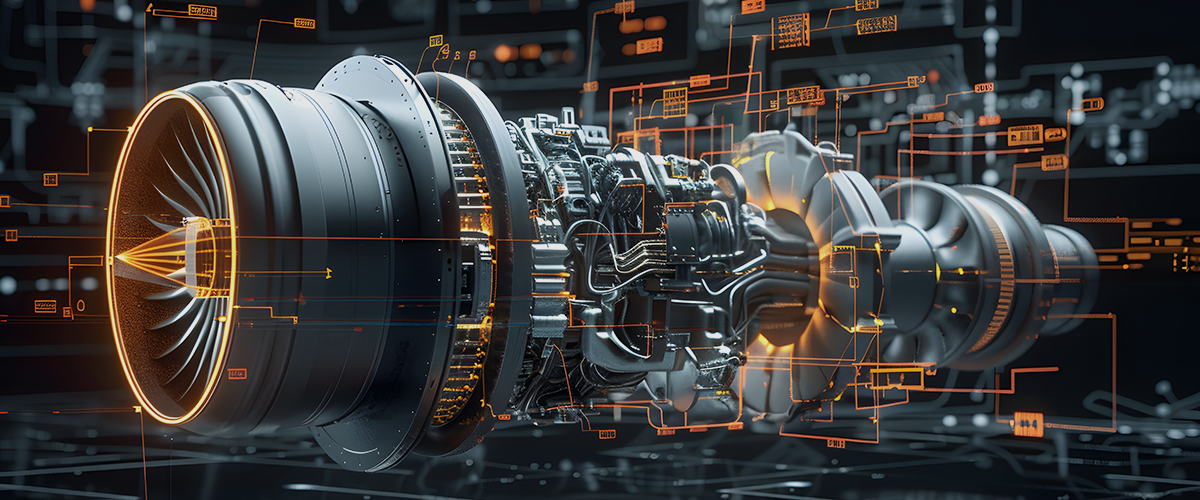

When it comes to engineering pedigree, MTU Aero Engines (“MTU”) represents the best of Bavaria. Born out of BMW in the early 1900s, it later acquired the aeroengine divisions of engineering elites - Maybach, MAN and Daimler-Benz. Prior to 1945, MTU developed aeroengines for the Luftwaffe. After World War II ended, and being barred from building engines for 10 years, the focus shifted to maintenance, repair and overhaul (“MRO”) for US forces stationed there. In the 1950s and 1960s, MTU recommenced engine production, but under third party licensing arrangements with General Electric (“GE”) and Rolls Royce (“RR”). It was only in 1969 that MTU established a joint venture (“JV”) with RR, to once again co-develop and manufacture a jet engine, powering the Tornado fighter-bomber.

In the 1970s, MTU blitzed the commercial market, signing a co-operation agreement with GE and a maiden manufacturing role on the Airbus A-300 engine. In the 1990s, MTU popped their co-development cork by forming a JV to power the Airbus A-320 with “risk-sharing” partners, Pratt & Whitney (P & W) and RR.

Today, MTU consists of two businesses: (1) original equipment manufacturing focusing on new engines and replacement parts (“OEM”), and (2) MRO shops. The profit split between the two is roughly 60/40. Though MRO does not have the glamour of OEM and generates lower profit margins; it is much less capital intensive. MRO is also more profitable (according to MTU’s segmental reporting, it has a superior return on assets). Within OEM, new engines are often sold at low margins to win orders, which are cross subsidised by high margin spare parts sales – so called “sunset harvesting”. Overall, MTU’s profitability is revving robustly.

Airlines don’t have much choice when it comes to aircraft, nor new engine suppliers. When choosing large passenger planes, there is a duopoly between Boeing and Airbus. Though there are theoretically three engine developers, with both the balance sheet and expertise to contest prime engine contracts (GE, P & W and RR), there is also an effective duopoly. In narrowbody, only GE and P & W compete and widebody is contested solely by GE and RR. Airlines have at most two engine options and sometimes no choice at all. When OEMs are contesting or aircraft manufacturers are awarding new engine options, there is a trade-off between OEM development costs (single option savings can be passed on), airline customers’ flexibility (one size doesn’t fit all routes), and the probability of success for stakeholders. Indeed, the three engine primes have hitherto included European (EU) equity “risk-sharing” partners, Safran and MTU in their JVs, to please the bureaucrats in Berlin and boost their chances of success with Airbus (Franco-German company) and EU national airlines.

In the aftermarket, aircraft engines are not like cars - one can’t just take the “old banger” to Kwikfit for its “MOT”. To maintain airworthiness and resale value, it must be serviced by an authorised MRO shop - the airline equivalent of a “main dealer”, where only (high margin) certified spare parts are fitted - a sticky stream of sunset sales. Though there are many MRO shops globally, the options dwindle when looking to service on the same continent (avoiding the need to fly the aircraft in question empty across the Atlantic).

Global passenger air travel is a growing industry, fuelled by ascending affordability. Increasing incomes (particularly in Asian developing countries) and fuel efficiency gains have provided the long-haul tailwind. Per the global trade body, IATA (International Air Transport Association), volume growth should continue to compound at approximately 3.8% per annum over the next 20 years.

MRO and spare parts growth will outpace OEMs and with less turbulence to boot. New generation engines run at hotter temperatures, due to more stringent emission requirements, resulting in more wear and tear and requiring shorter servicing intervals (than previous generation engines). Hence, the quicker uptake of new engines will boost the frequency of future MRO shop visits (and thus top-line revenue). In contrast, the slower uptake of new engines will necessitate sweating of the existing fleet for longer (thereby boosting bottom-line profits through a higher margin on the stale spare parts mix). Heads you win, tails you don’t lose!

We got the opportunity to buy MTU in the Credo Global Equity Fund in early 2024, when it was unduly discounted due to their exposure to P & W’s geared turbofan engine recall, which was the subject of our equity spotlight article in December 2023. Raytheon Technologies, which owns P & W, has been a long-term holding in both the Credo Best Ideas and Dividend Growth portfolios. As the “wurst case” fears are now abating, we think MTU can rerate closer to EU OEM peers, Safran and RR.

MTU’s multiple had long lagged EU OEM’s, due to the drag of its MRO business which was shunned as “low margin” by sell side analysts (despite superior profitability). Hitherto having no listed comparable, it seemed somewhat orphaned. However, in the past few months there have been two events which could improve MRO sentiment and catalyse a closing of the discount:

- Standard Aero, the second pureplay engine MRO globally, was listed in the US at a nosebleed multiple and ascended in altitude at one point north of GE (US OEM). In the home of the brave, there is no MRO discount.

- Lufthansa held a capital markets day for their MRO division, Lufthansa Technik. There have long been rumours that Lufthansa is considering strategic options such as an IPO or spin off – which would put a P/E multiple on Technik. Though their MRO business is broader, covering bodywork in addition to engines, the 83-page presentation highlighted engine MRO as the crown jewel, “powering growth” estimated at between 11% - 13% CAGR from 2023 to 2030, much higher than their overall estimate of more than 7%.

MTU has an investor day scheduled later this year, when long-term guidance could be updated. Prior to Covid-19, these were scheduled annually, though their last one was held in 2022 when visibility was weak. Since then, turbulence has subsided, and the long-haul cruise corridor seems clearer. If EU investors can learn to love MRO as much as they do in the US, we believe there is no reason why MTU cannot trade at par with EU OEM peers. That would be a landing worthy of applause.

This communication does not constitute an investment advertisement, investment advice or an offer to transact business. The information and opinions expressed in this communication have been compiled from sources believed to be reliable. None of Credo, its directors, officers or employees accepts liability for any loss arising from the use hereof or reliance hereon or for any act or omission by any such person or makes any representations as to its accuracy and completeness. Any opinions, forecasts or estimates herein constitute a judgement as at the date of this communication. Credo Capital Limited is a company registered in England and Wales, Company No: 03681529, whose registered office is 8-12 York Gate, 100 Marylebone Road, London, NW1 5DX. Authorised and regulated by the Financial Conduct Authority (FRN:192204). © 2025. Credo Capital Limited. All rights reserved.