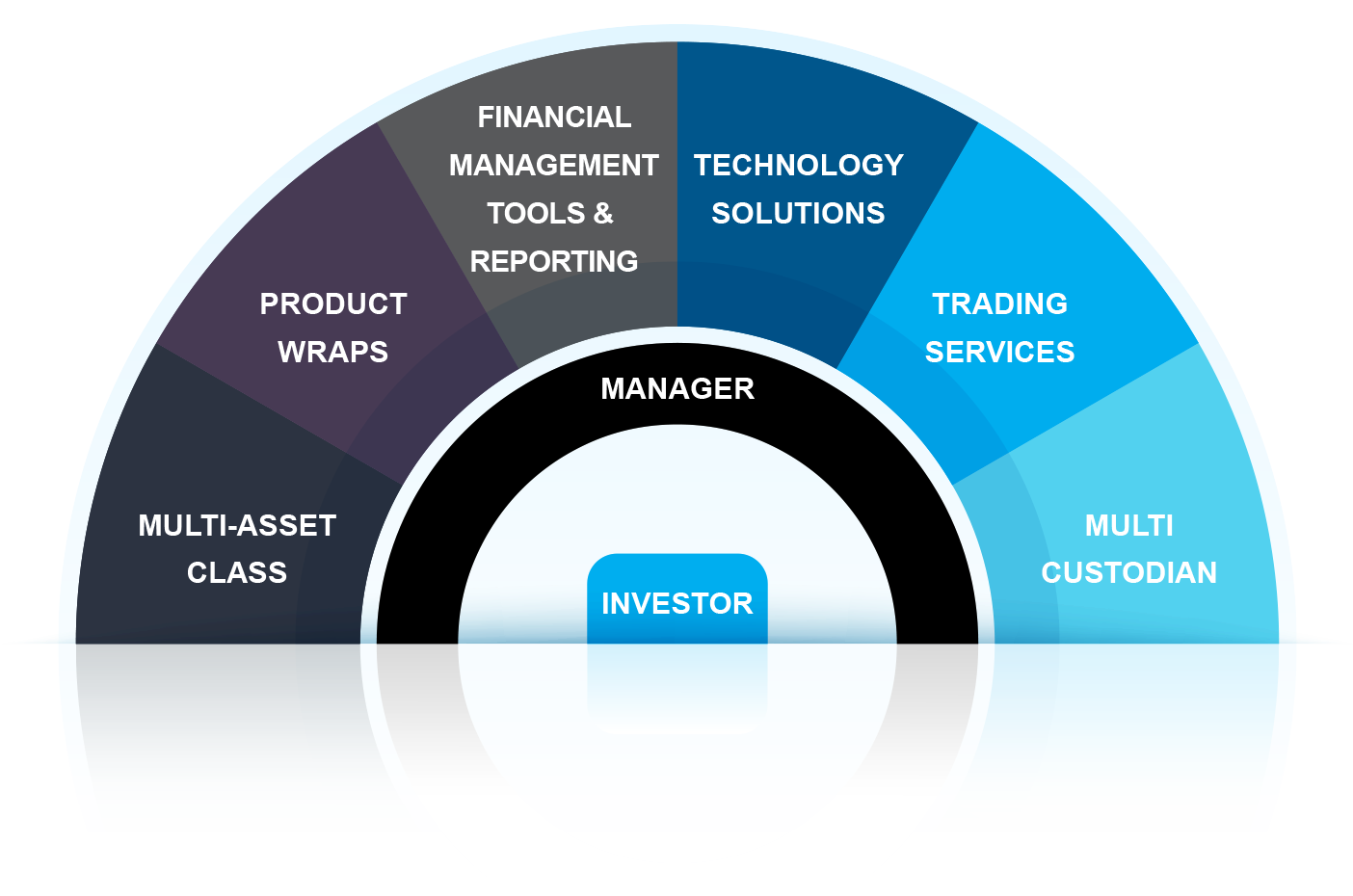

Wealth Platform

Financial Intermediaries benefit from the following

Multi-asset class

Offer access to global equities, fixed income, whole of market mutual funds and hedge funds

Cash management

Client Money is managed in the Investors' currency of choice

Lending

Ability for Investors to borrow against the market value of qualified securities for investment, personal or business reasons

Product wraps

Leverage Credo as ISA manager; and access a network of wrapper providers, including SIPP, Onshore Bonds and Offshore Bonds

Multi-currency

Support Investors' currency preferences where cash management and performance reporting is reflected in the Investors' currency of choice

Multi-custodian

Access is also provided to an Offshore custodian, should this be required

Our Solutions

Credo's platform includes the following solutions, allowing Financial Intermediaries to provide a holistic wealth management service to their clients:

Business Models

Credo provides Wealth Solutions to Financial Intermediaries, including Wealth Managers, Financial Advisory Firms and Family Offices in the UK, Channel Islands, Europe, Australia and South Africa.

We offer two business models that provides Financial Intermediaries with flexibility to choose the model that suits their particular circumstances and Credo further supports the migration between business models as your business needs evolve and mature:

|

Outsource ('White-labelled') |

Regulatory Umbrella ('White-labelled') |

|

| Contracting party | Regulated entity | Regulated entity via Principal |

| Branding | White-labelled |

White-labelled 'as a trade name of Principal utilised under an exclusive license' |

|

Regulatory - Individual - FCA Registration |

Regulated entity | Principal, as regulated entity |

|

Regulatory - Compliance - Supervision / Monitoring |

Regulated entity | Principal, as regulated entity |

|

Regulatory - PI cover |

Entity responsible for own PI | Entity responsible for own PI |

|

Investor - TOB |

Regulated entity TOB | Principal TOB |

|

Investor - Client of |

Regulated entity | Regulated entity via Principal |

| Premises | Client decision | Client decision |

| Pricing Model | Service based | Service based |